-Dr James Edmondson, Research Director at IDTechEx

Electric vehicle (EV) fire safety continues to be a critical topic. Data continues to support the fact that EVs are less likely to catch fire than internal combustion engine vehicles. However, as a new technology, EVs get more press, and besides, even a very low occurrence rate still poses significant risks to vehicle occupants and surroundings. It is also unclear what the impact of aging vehicles on the risk of thermal runaway will be. Effective thermal management, quality control, and battery management systems minimize the risk of thermal runaway occurring, but fire protection materials are the primary method of either preventing the propagation of thermal runaway or delaying its progression long enough to meet regulations and provide safety for occupants. IDTechEx predicts the EV market (including cars, two-wheelers, three-wheelers, microcars, LCVs, trucks, buses, boats and ships, construction vehicles, trains, and air taxis) will be worth US$3.5 trillion in 2044, with so many vehicles in operation, safety will be paramount.

IDTechEx’s new report, “Fire Protection Materials for EV Batteries 2024-2034: Markets, Trends, and Forecasts”, analyzes trends in battery design, safety regulations, and how these will impact fire protection materials. The report benchmarks materials directly and in application within EV battery packs. The materials covered include ceramic blankets/sheets (and other non-wovens), mica, aerogels, coatings (intumescent and other), encapsulants, encapsulating foams, compression pads, phase change materials, and several other materials. 10-year market forecasts are included by material and vehicle category.

The evolution and variety of battery design

Various cell formats and battery structures are used in the EV market. According to IDTechEx, in 2022, 55% of new electric cars sold used prismatic battery cells, with pouch cells accounting for 24% and the rest using cylindrical. Each of these cell formats has different needs in terms of inter-cell materials, which has led to trends in fire protection material adoption. For example, cylindrical systems have largely used encapsulating foams, whereas prismatic systems typically use materials in sheet format, such as mica.

Many manufacturers are also moving towards a cell-to-pack design where module housings (and a host of other materials) are removed, leading to improved energy density but potentially more challenging thermal runaway propagation prevention. These design choices all greatly impact the choice and deployment of fire protection materials.

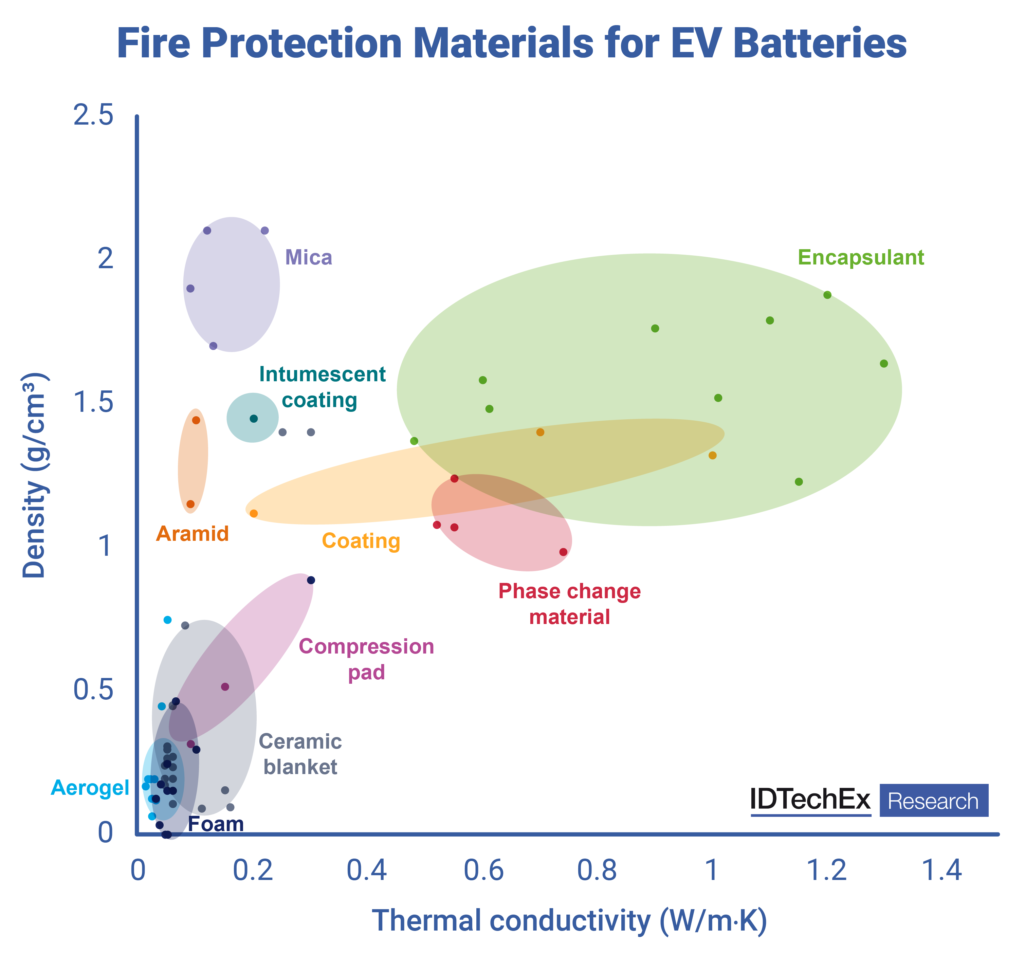

Many materials are applicable for fire protection in EV batteries. Source: IDTechEx – “Fire Protection Materials for EV Batteries 2024-2034: Markets, Trends, and Forecasts”

Key properties for fire protection materials

Many properties are key for choosing the optimal fire protection material, thermal conductivity, density, thickness, dielectric strength, maximum fire protection temperature, and cost. Each of these factors is important in isolation but must be considered at a pack level. A material can be very lightweight, but if a large amount is required in order to provide protection, then it may not be the best solution. Likewise, if a material has to be paired with others to provide all the necessary functions, then it may impact its performance and cost-effectiveness.

As an example, IDTechEx research finds that an aerogel blanket used for pack-level protection would be approximately 25% lighter than the equivalent mica. For cell-level protection, mica and aerogels can have a similar weight per kWh of battery, but other considerations should be made for compression performance and thickness, which will impact volumetric energy density.

Options for fire protection materials

Ceramic blankets have been a common choice to provide protection above the cells and below the lid and to delay the propagation of fire outside the pack. Mica sheets are another popular choice with excellent dielectric performance at thin thicknesses between cells but are often used in thicker sheets above modules. Aerogels are continuing to see market progress with significant adoption in China, but also now globally with adoption from GM, Toyota, and Audi, to name a few.

The use of encapsulating foams has also seen significant adoption for cylindrical cell battery packs, with the likes of Tesla, to provide lightweight thermal insulation and structure. For pouch cells, compression pads are commonplace to accommodate cell swelling, and several material suppliers are starting to combine this functionality with fire protection to provide a multifunctional solution.

There are many material options in addition to the ones discussed above, and polymer suppliers are making a big push to provide major components of the battery pack with fire-retardant polymers or even polymers with intumescent properties. These have the potential to be lighter, more customizable in geometry, and lower cost than metals and fire protection materials combined. However, there are still significant challenges here, such as integrating EMI shielding and providing the necessary crash performance.

Outlook

The EV market continues its strong growth, and with more vehicles on the road, it is becoming more critical than ever to provide effective protection from thermal runaway. Regulations are continuing to develop, putting a greater focus on battery safety, leading to greater opportunities for material suppliers. However, as vehicle makers are striving to reduce costs, providing materials that can cater to multiple functions at a reasonable price point is key to their future progress.

IDTechEx’s report, “Fire Protection Materials for EV Batteries 2024-2034: Markets, Trends, and Forecasts”, finds that the EV battery fire protection material market will grow at 16.1% CAGR between 2023 and 2034. The report considers the market shares of various material options, upcoming regulations, and the shifts in battery design, such as cell format, cell-to-pack, and more, to determine volume and value forecasts across on-road vehicle categories, including cars, vans, trucks, buses, 2-wheelers, 3-wheelers, and microcars.