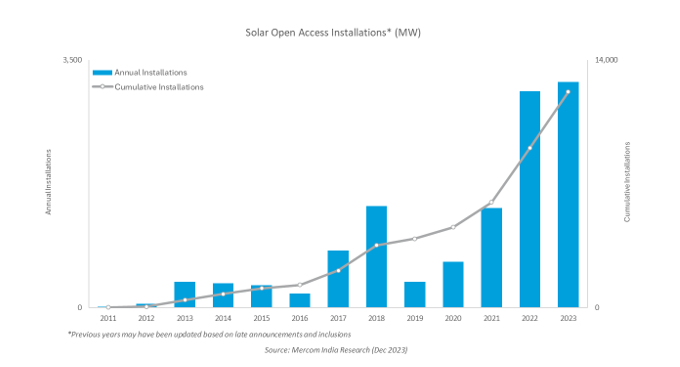

March 08, 2024 – In calendar (CY) 2023, India added 3.2 gigawatts (GW) of solar open access capacity, an increase of 5.7% compared to the 3 GW installed in 2022, a record for annual installations, according to the newly released report, 2023 Q4 & Annual Mercom India Solar Open Access Market Report.

The extension of the Approved List of Models and Manufacturers (ALMM) order until March 2024 and falling module prices spurred commercial and industrial (C&I) consumers to commission pending projects and sign new PPAs. Declining system costs, favorable policies, and the Green Energy Open Access Rules in several states fueled solar installations through the open access market in 2023.

“Open access solar is one of the bright spots in India’s solar market, attracting commercial enterprises and industrial units to shift towards solar and other clean energy sources. The potential cost savings for businesses are hard to ignore, especially as solar costs continue to decrease while retail electricity prices rise. With a strong pipeline, the outlook is very promising for this market segment, and we anticipate strong growth in 2024,” said Raj Prabhu, CEO of Mercom Capital Group.

Cumulative installed solar capacity in the open access segment stood at 12.2 GW as of December 2023.

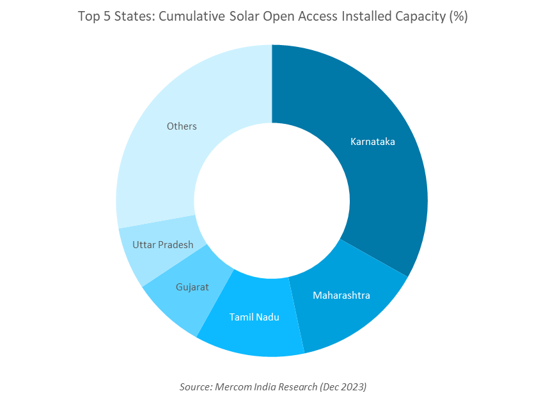

Karnataka remained the top state for cumulative installations, accounting for 33.1% of the country’s installations, followed by Maharashtra (13.5%) and Tamil Nadu (11.4%).

The top five states contributed 72.2% to the country’s cumulative open access solar installations as of December 2023.

India had 13.9 GW of projects under development and in the pre-construction phase at the end of Q4 2023.

India added 831.2 MW of open access solar in Q4 2023, a 22.8% quarter-over-quarter (QoQ) drop, but up 6.2% year-over-year (YoY) compared to 782.5 MW in Q4 2022.

“Other than the larger conglomerates and international brands with presence in India, the domestic industries are also seriously considering green energy open access. Responsible steel, green cement, and sustainability initiatives across sectors have been adding to the demand for green power in larger scale,” commented Priya Sanjay, Managing Director at Mercom India.

Karnataka led all states and accounted for 27.9% of open access solar capacity in 2023. Gujarat and Maharashtra followed with 16.4% and 16.2% share of annual installations, respectively. The top five states accounted for 84.1% of the total installations in the year.

While lower PPA prices resulted in higher capacity additions YoY, installations dropped QoQ as several developers completed their projects in Q3 and signed new PPAs in Q4, which are expected to increase capacity additions in the upcoming quarters.

In Q4 2023, Tamil Nadu led all states, accounting for 24.8% of total open access solar installations. Rajasthan ranked second and Karnataka third with 23.3% and 15.8% share of total capacity additions in Q4, respectively.

The top five states accounted for 83.6% of solar open access installations in Q4 2023.

Karnataka led the Green Day Ahead Market (G-DAM) in power sold through the exchange, with 82.5 MUs accounting for 16.2% of the market.

Damodar Valley Corporation became the leading energy procurer from the G-DAM with 93.6 MU, followed by Maharashtra with 65.6 MU, representing 18.4% and 12.9% of the traded volume, respectively.

On the Indian Energy Exchange (IEX), 2,17,023 Renewable Energy Certificates (RECs) were traded in October, 7,54,970 in November, and 1,052,230 in December.

According to the report, the volume traded in the Green Term Ahead Market (G-TAM) on IEX fell 39% QoQ.

A detailed analysis of the solar open access market, retail electricity tariffs, and open access charges and costs for seventeen states has been covered in the report.

Key Highlights from Mercom India Research’s Q4 2023 India Solar Open Access Market Report

India added over 3.2 GW open access solar in CY 2023, up 5.7% from the 3 GW installed in 2022

Karnataka led all states, contributing 27.9% of new open access solar capacity in 2023

India added 831.2 MW of open access solar in Q4 2023, a 22.8% QoQ drop from 1,077 MW installed in Q3 2023

The total installed solar capacity in the open access segment stood at 12.2 GW as of December 2023

13.9 GW of open access solar projects were in the development pipeline at the end of CY 2023